Best Practices for Posting Payment and Handling Complex Remittance Advice

The accuracy of the payment posting and the efficiency in handling the remittance advice have become the essential components for a financially healthy and stable practice. Because every transaction recorded correctly means fewer reconciliation errors, faster cash flow, and a more accurate financial picture. Healthcare providers can no longer consider the payment posting as a simple back-office task as getting them right especially when remittance advice is complex have become one of the highest-leverage activities for improving cash flow, reducing the days in A/R and lowering the audit risks. In this blog post we will cover the practical and implementable best practices for payment posting, strategies for interpreting the Remittance Advice/ERA/EOBs while focusing on accuracy, automation, compliance and strategic process improvement.

Understanding Payment Posting and Remittance Advice

What is Payment Posting?

Payment posting is the process of recording the payments that were received from the payers or patients into the organization’s accounting or revenue management system. It indicates the settlement of claims by the insurance companies reflecting the completion of a financial transaction.

What is Remittance Advice?

Remittance advice (RA) is the detailed communication sent by a payer to explain the payment made. It outlines how the payment amount was calculated, which claims or invoices were paid or denied, and what adjustments were applied.

Why does the accuracy of payment posting matters?

Accurate payment posting ensures that every dollar received is correctly applied to the right patient and claim, protecting the practice’s revenue. It helps to prevent underpayments, overpayments, and write-off errors that can silently drain cash flow. High accuracy also reduces rework, denials, and audit risks helping to maintain the revenue cycle clean, compliant, and predictable. Real-world outcomes of poor posting include:

- • Increased AR days and slower cash collections.

- • Escalation of disputes when patients receive incorrect statements.

- • Risk of audit findings when contractual adjustments and CARC/RARC codes are misapplied.

- • Waste of the Staff time in chasing mistakes.

Payment posting is a strategic part of the Revenue Cycle Management (RCM). Each accurately posted transaction contributes to a transparent financial workflow, ensuring that payments, adjustments, and denials are correctly categorized with clarity to improve the financial reporting, collections, and cash forecasting.

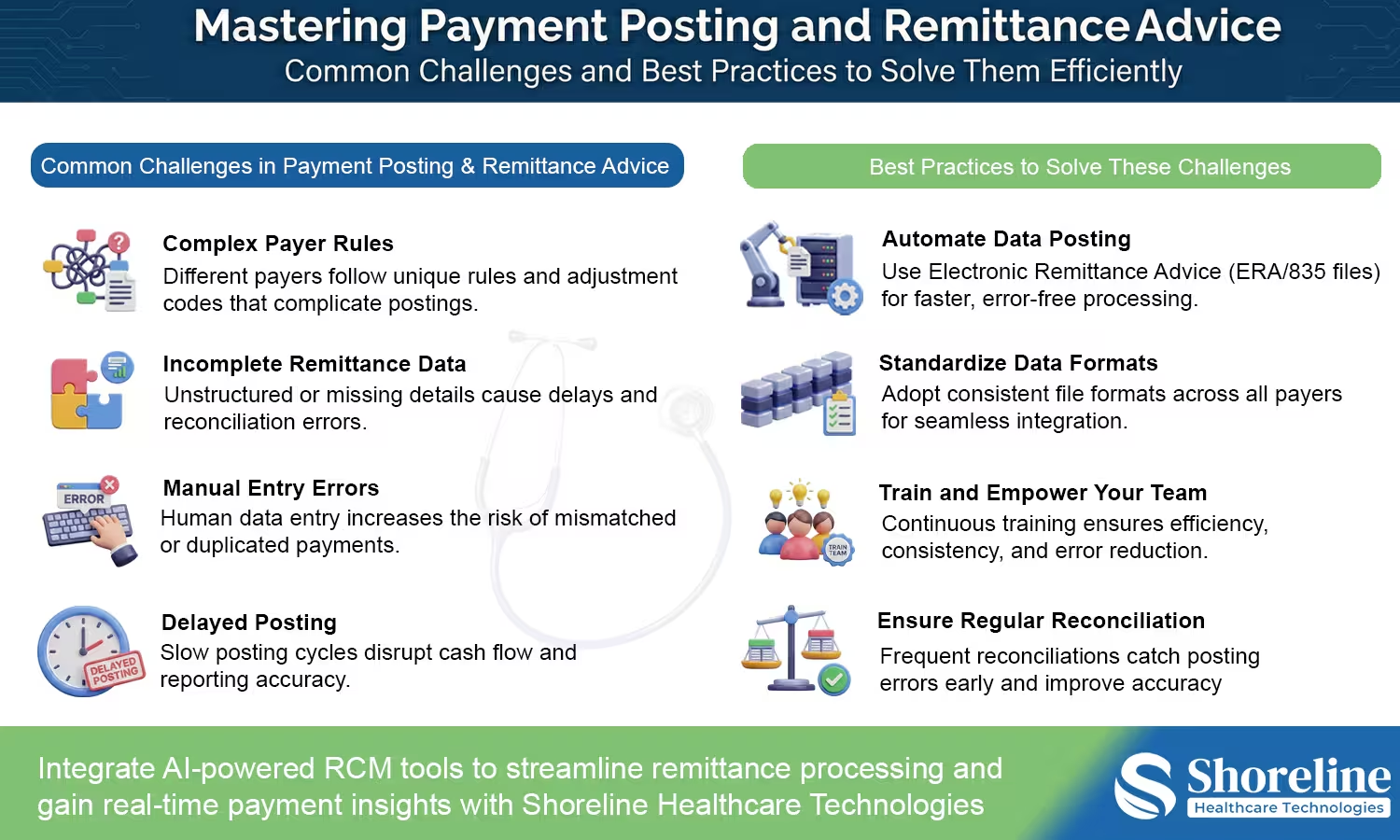

Common Challenges in Payment Posting and Remittance Management

➣ Complex Payer Rules and Adjustments

Each payer has their own sets of adjustment codes and reimbursement models. Keeping up with these variations manually can slow down the process delaying the posting or resulting in incorrect postings.

➣ Unstructured or Incomplete Remittance Data

Paper-based remittance advice or poorly formatted electronic files often lack the structured data that is necessary for automated posting. This might lead to the need for more manual review that increases the time required along with higher chances of human error.

➣ Errors due to Manual Posting and Inefficiencies in Data Entry

Posting payments using manual input are highly prone to errors like mismatched claim numbers, incorrect payment amounts, or duplicate entries.

➣ Delayed Posting and its Impact on Cash Flow

Delay in posting payments directly affects the cash flow visibility and hinders the operational decision-making.

The step-by-step process of payment posting

Step 1: Prioritize ERA/EOBs on receipt

- ✔ Automatically ingest ERAs from clearinghouses where possible.

- ✔ Flag any zero-pay, partial-pay, or unusual adjustment lines for manual review.

- ✔ Use payer-specific rules to route remittances for manual review when necessary.

Step 2: Match remittance to claims

- ✔ Apply the ERA/EOB to the claim using the claim number and service date.

- ✔ Validate allowed amounts against contracted rates and note contract adjustments.

- ✔ If payer remit indicates a bundled service or crosswalk adjustment, tag the claim for coding/billing review.

Step 3: Post payments and adjustments

- ✔ Post insurance payments to the proper ledger.

- ✔ Apply CARC and RARC correctly and note down the reasons.

- ✔ When a partial payment is received, create an accurate workflow for the patient responsibility balance and set up the other follow-up tasks like secondary billing, patient statements, payment plans.

Step 4: Reconciliation and deposit matching

- ✔ Reconcile posted payments with the daily deposits.

- ✔ Investigate batched mismatches immediately to avoid misapplied cash.

- ✔ Maintain weekly aging of unposted ERAs and unallocated payments.

Best Practices for Accurate Payment Posting

➣ Automating Payment Posting Using Technology

Use Electronic Remittance Advice (ERA) and automated reconciliation tools, to speed up the processing times and improve the accuracy rates. With automations the dependency on manual work is reduced allowing the team to focus on more value-driven tasks like denial management and payer relationships.

➣ Standardizing Data Formats and File Types

Adopt formats like ANSI 835 that helps to integrate multiple payer systems seamlessly and maintain consistency across the various payer.

➣ Training and Empowering the Payment Posting Team

Keep educating the team to identify the irregularities in the payment pattern and fix them before they start affecting the financial stability. Keep them updated with the frequent policy changes and other payer guidelines.

➣ Ensuring Reconciliation and Audit Trails

Create a robust audit trail for maintaining the compliance and transparency. Automated systems create log of every action and provides full traceability of who posted what, when, and why that supports both the internal audits and external compliance checks.

Handling the Complex Remittance Advice Scenarios Effectively

Partial payments

- ✔ Always determine whether the partial payment is due to a deductible, coinsurance, or underpayment.

- ✔ If deductible/coinsurance, calculate the correct patient responsibility and create an actionable follow-up (statement, patient balance call, or payment plan offer).

Bundled service payments

- ✔ Payers sometimes pay for a bundle of services with a single line on the remittance. Compare billed services and map payments proportionally or per contract rules.

- ✔ Document the allocation method used and retain it for potential audit justification.

Secondary and tertiary payer posting

- ✔ Verify coordination of benefits and post the payment from the primary payer first followed by the secondary remittance and ensure there is no duplicate adjustments.

- ✔ For crossover claims, confirm whether the ERA includes crossover details or whether the secondary payer will send a separate remit.

Recoupments and takebacks

- ✔ When funds are recouped, document the recoupment reason, link it to original paid claims, and evaluate whether to appeal or adjust contract interpretations.

- ✔ Communicate recoupments promptly to providers if they affect the expected reimbursement.

Zero-pay remittances and denials within the ERA

- ✔ Treat zero-pay ERAs as priority exceptions as they may contain denials or qualitative explanations.

- ✔ Start denial workflows from these remittances and set service level agreements for response/appeal.

Compliance and Security in Payment Posting

Compliance and data security are fundamental aspects while handling payments and remittance advice, healthcare organizations must comply with strict regulatory frameworks to protect the sensitive patients financial and personal data.

➣ HIPAA Compliance and Data Privacy Considerations

In healthcare industry it is mandatory to adhere to the Health Insurance Portability and Accountability Act (HIPAA) that have set strict standards for maintaining the security and privacy of the patient data. All process involving payment posting must ensure that Protected Health Information (PHI) is encrypted, stored, and shared securely only with authorized personnel. All financial institutions must comply with the Payment Card Industry Data Security Standard (PCI DSS) to ensure secure handling of payment information for minimizing the fraud risks.

➣ Secure Payment Channels and Data Encryption

All electronic transactions can be implemented through Zero Trust Architecture model that uses multi-factor authentication (MFA), and role-based access control (RBAC). Automating the posting via encrypted Electronic Data Interchange (EDI) files can minimize the human intervention and reduces the likelihood of data exposure. In order to ensure trust and compliance, healthcare organizations should adopt high end security features that continuously monitor the systems and detect the irregularities in payment patterns or unauthorized data access.

Future Trends in Payment Posting and Remittance Automation

Real-Time Payment Reconciliation

The future of payment posting lies in real-time reconciliation. Modern systems are being built to post payments instantly as they are received, providing organizations with up-to-date cash positions and financial clarity.

Predictive Analytics and AI-Powered Denial Management

Machine learning models are now being trained to predict potential claim denials before submission and to auto-correct mismatched remittance data. These predictive tools will drastically reduce revenue leakage and enhance payer collaboration.

Integration with Blockchain Technology for Transparency

Blockchain technology provides an immutable record of financial transactions, offering unparalleled transparency in payment posting. It also helps to eliminate the disputes between payers and providers by their shared, tamper-proof payment data.

Adoption of Cloud-Based RCM Platforms

The adoption of cloud-based RCM platforms enables the remote posting teams to collaborate in real time, to ensure the continuity of the process even during disruptions. With these cloud-based systems organizations can scale their operations effortlessly while maintaining compliance and security.

We at Shoreline Healthcare Technologies combine our deep expertise in revenue cycle management with practical and scalable automation solutions to reduce the friction of payment posting and remittance handling. Our solutions are designed to work in real-world environments, with frequent changes in payer and widely varying remittance formats.

We have a robust payer rule libraries that are updated regularly, so that the posting teams can easily adapt when the payers modify their formats, codes, or reimbursement logic. In addition to this our hybrid payment posting model creates a right balance between automation and human expertise by automating the high-volume, consistent ERAs while exceptions and complex remittances are handled by dedicated specialist reviewers who ensure precision and compliance.

By blending automation with expert oversight, we have helped healthcare organizations to improve their posting accuracy, reduce turnaround times, and gain clearer visibility into their cash flow. To learn more about how Shoreline Healthcare Technologies is shaping the future of revenue cycle operations through AI-driven automation and expert-led solutions, read our featured article, Shoreline Healthcare Technologies Driving the Future of Revenue Cycle Management with AI, Automation, and Expertise.

FAQs

Q1. What are the essential KPIs to track the performance of payment posting?

+Days in A/R, posting accuracy rate, denial rate, and posting turnaround time are the key metrics that can be tracked to measure efficiency of payment posting and identify the areas for process improvement.

Q2. What do you mean by CARC and RARC and why do they matter?

+The Claim Adjustment Reason Codes (CARC) and the Remittance Advice Remark Codes (RARC), are the codes present in the remittance advice that gives the explanation about why the payment was adjusted, denied, or reduced. Correct interpretation of these codes is an important aspect for accurate payment posting, denial management, and appeals.

Q3. What is the difference between ERA and EOB?

+An ERA is a standardized electronic remittance file that can be auto posted into billing systems, while an EOB is typically a paper or PDF document that requires manual review and posting.

Q4. What are the most common payment posting errors?

+Errors in payment posting can occur due to

- ✔ Misapplied payments

- ✔ Incorrect contractual adjustments

- ✔ Ignoring CARC/RARC codes

- ✔ Posting payments to the wrong claim or service line

- ✔ Creating incorrect patient responsibility balances

Q5. Is ShorelineMB the same as Shoreline Healthcare Technologies?

+Yes, ShorelineMB.com is the official website of Shoreline Healthcare Technologies, a leading provider of medical billing and RCM services.

Contact Shoreline Healthcare Technologies Today to Eliminate your Posting Delays and Take Control of Your Payment Accuracy.