The Critical Link Between Front-Desk Processes and Back-End Revenue Leakage

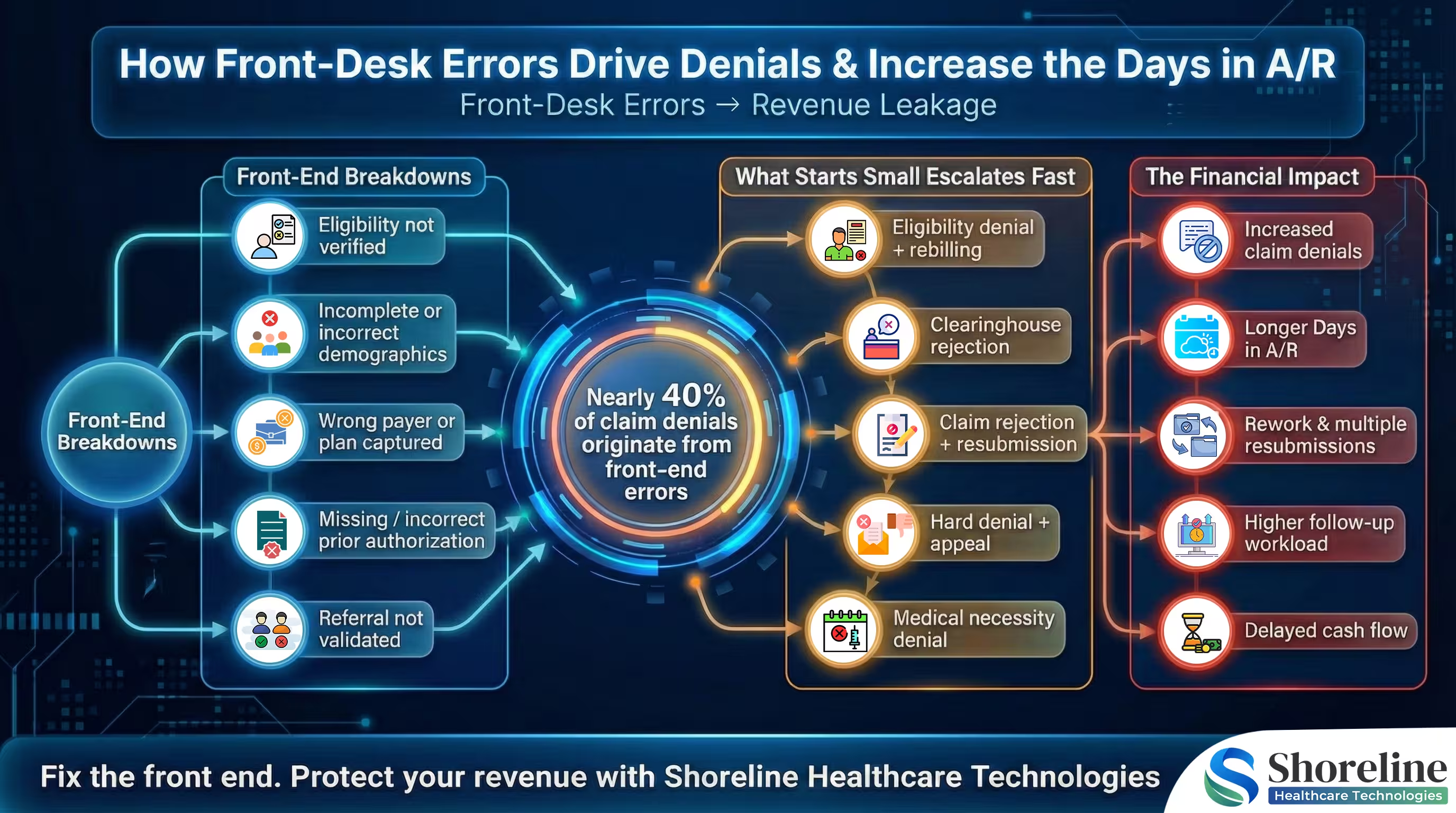

Whenever we talk about the revenue leakages in the healthcare industry our focus is only on the billing, coding, or claims denials. And most of the organizations mainly concentrate on denials management, AR follow-ups, and payer negotiations for recovering their revenue. While these back-end activities are important, they only address the symptoms and not the source of revenue loss. Studies estimate that nearly 30–40% of revenue leakage originates from front desk processes. They are the heartbeat of any healthcare facility. They set the stage for patient experiences and operational efficiency. They are the first point of contact for patients and the first gatekeepers of the revenue cycle. From patient registration to eligibility verification each process directly shapes what happens downstream in coding, charge capture, claim submission, and reimbursement, so that any errors in the front-end ripples and compounds as it moves through the revenue cycle, silently draining profits. In this blog, let us explore the critical link between the front-desk processes and back-end revenue leakage, uncovering the most common front desk errors in medical billing, and how hospitals can close these revenue gaps through front-end revenue cycle management, automation, and workflow optimization.

Understanding Front-End Revenue Cycle Management (RCM)

Defining the Front-End RCM Process

The front-end revenue cycle encompasses all patient-facing administrative tasks that occur before the care is delivered like registration, eligibility verification, insurance capture, authorizations, and scheduling. Each task lays the groundwork for subsequent healthcare services. So, errors at this stage are not just clerical but affect the entire RCM.

How does the Front-Desk Workflows shape the financial outcomes?

The front-desk processes are the ones that determines whether the services are billable and ensures the submission of clean claims in compliance with the payer-specific requirements in timely manner. They have direct and measurable impact on the medical billing, so that any failure in the workflow might lead to incomplete data delaying the billing cycle and increasing the denial rates. Therefore optimizing the front-end workflows is essential for any organization looking to plug revenue leaks before they reach the billing department.

Common Front-Desk challenges that lead to Revenue Leakage

Insurance Eligibility Verification Errors

Eligibility verification errors are among the most expensive front desk mistakes that lead to significant delays and denials. It is one of the critical front-desk tasks with mistakes stemming from the incomplete or outdated information due to the frequent policy updates and coverage requirements by the payer. So, it is important for the front-desk team to stay informed and verify the coverage details well in advance. Completing this process before the appointments reduces surprises and disputes and helps healthcare providers receive their due compensation.

Registration and Demographic Errors

Registration and demographic inaccuracies are the most common and most underestimated front-desk challenges that directly leads to revenue leakage. The front-desk teams are responsible for getting the complete details that helps to process the claims and route them correctly for reimbursement, because even a single incorrect field can break the entire billing workflow.

Common Registration and Demographic Errors Include:

- • Misspelled patient names or name mismatches with payer records

- • Incorrect date of birth or gender

- • Incomplete or outdated address and contact information

- • Wrong guarantor or subscriber details

- • Missing middle initials or suffixes required by payers

- • Incorrect relationship-to-subscriber selection

How does demographics errors cause revenue leakage?

When demographic data does not exactly match payer records, claims are often rejected before adjudication, increasing rework and resubmission costs extending the days in AR with increased cash flow gaps. These claims might also face the chances of underpayment or write offs when these corrections are not made in timely manner. Unlike billing or coding errors, these demographic errors often go unnoticed and remain as a leading contributor to the revenue leakage.

Wrong Payer or Plan Captured

Capturing the wrong payer or incorrect insurance plan at the front desk is a high-impact front-end error that could be avoided. This error typically occurs when front-desk staff select an outdated, inactive, or incorrect plan from the insurance system, or when multiple coverages (primary, secondary, tertiary) are not identified correctly at intake. While it may seem like a simple selection mistake during registration, its downstream consequences are extensive and expensive.

When the incorrect payer or plan is captured:

- • Claims that are sent to the wrong insurer are rejected

- • Timely filing deadlines may be missed during rebilling

- • Coordination of benefits (COB) errors can delay adjudication

- • Payments denied might increase the AR days

In many cases, by the time the correct payer is identified, the claim would have already aged beyond recovery turning a correctable mistake into permanent lost revenue.

Missing or Incorrect Prior Authorization

Prior authorization is a payer requirement that confirms the medical necessity of the service and its eligibility for reimbursement before the delivery of the service. Missing this step or submitting an incomplete or incorrect authorization might lead to financial consequences that often-surface weeks later as claim denials or zero-dollar payments.

In many healthcare organizations, prior authorization failures occur during scheduling or patient intake. Front-desk staff may rely on outdated payer rules, misunderstand service-specific authorization requirements, or fail to document authorization numbers accurately in the system. Even when authorization is obtained, entering an incorrect authorization code or linking it to the wrong procedure can invalidate the approval entirely. These small errors create major downstream problems in the healthcare front-end revenue cycle.

The impact of missing or incorrect prior authorization extends beyond denied claims. Rework costs rise as billing teams spend hours appealing denials that are rarely overturned. In many cases, services must be written off entirely, contributing to silent revenue loss in hospitals. High-cost procedures such as imaging, outpatient surgery, and specialty care are especially vulnerable, making prior authorization errors a leading cause of medical billing revenue loss.

Referral Not Validated

Referral not validated is a frequent yet underestimated driver of front desk revenue leakage. Many payer plans require a valid referral from a primary care provider before specialty or diagnostic services are rendered. Even minor discrepancies like an incorrect referring provider ID or an expired referral period can invalidate the entire referral with a significant financial impact. Claims denied for referral-related reasons are among the hardest to appeal and increases the write-offs regardless of the medical necessity of the care delivered. Referral validation failures occur when the front-desk staff overlooks the payer-specific referral rules during appointment scheduling or patient check-in and fails to confirm whether the referral matches the exact provider, service, and date of care.

Strategies to prevent the Front-End Revenue Leakage

Preventing this front-end revenue leakage requires a more proactive approach with standardized workflows and technology-enabled accountability at the point of patient access.

Standardize the Front Desk Processes

By establishing a standardized protocols for the registration, we can replace the guesswork with repeatable, compliance-driven workflows. This helps to reduce the variations and errors that occurs in the front-end and ensures every patient encounter starts with clean, billable data.

We at Shoreline Healthcare Technologies helps providers to transform their fragmented front-desk operations into high-performing, revenue-safe intake workflows through a combination of process design, automation, and accountability.

➢ Structured Registration Checklists

We have implemented a standardized, payer-aware registration checklists that ensures every required demographic, insurance, and guarantor field is captured accurately every time.

➢ Standard Eligibility Verification Timelines

Our consistent eligibility verification at predefined touchpoints (pre-visit, check-in, and same-day services), reduces the last-minute surprises and coverage-related denials.

➢ Defined Authorization Ownership

The clear role-based workflows, ensures authorization is never skipped preventing the missed approvals, delayed services, and write-offs.

Automate Patient Access Workflows

At Shoreline Healthcare Technologies we have embedded intelligent automation into some of our front-end workflows without disrupting the daily operations.

Our Key Automation Capabilities Include:

- ➢ Real-Time Eligibility Verification : We have automated eligibility checks at scheduling, pre-registration, and check-in ensuring coverage, payer rules, and benefit limitations are verified before the services are rendered.

- ➢ Automated Payer & Plan Matching : Our intelligent payer-plan mapping eliminates wrong-payer selection by validating the correct plan and identifying primary, secondary, and tertiary coverage automatically.

- ➢ Prior Authorization Tracking & Alerts : Shoreline have replaced the manual authorization follow-ups with automated status tracking, deadline alerts, and exception handling preventing missed approvals.

- ➢ Data Validation at Intake : Our built-in validation rules flag incomplete or inconsistent demographic and insurance data in real time, allowing front-desk teams to correct the issues immediately.

Investing in these RCM automation tools, enables data validation, smart prompts and instant error detections that optimizes the front desk operations and transforms the human errors into digital precision.

Align Front Desk and Back-End Teams to Close Revenue Gaps

Shoreline Healthcare Technologies helps organizations to create a shared accountability between the front desk and billing teams for clean-claim outcomes. We have standardized the front-end workflows, so coders and billers receive the complete valid data. We trace back the denial and underpayment trends to the specific front-end root cause and train teams together to make them understand the payer rules, coding requirements, and reimbursement realities.

Shoreline’s analytics-driven approach helps providers

- ✔ Identify high-risk registration and eligibility failures before claims are submitted

- ✔ Quantify revenue at risk from front-end errors and underbilling

- ✔ Track performance by department, location, and payer

- ✔ Prioritize process improvements based on financial impact.

With a deliberate focus on the front-end accuracy, accountability and addressing them at the early stages organizations can protect and improve their long-term financial stability. Advanced automation and analytics are playing a growing role in strengthening the revenue cycle performance. Read our PR article that underscores the importance of strengthening the front-end controls like eligibility verification, referral validation, and prior authorization for reducing the denials and improving the operational efficiency.

FAQs

Q1. What are the common Revenue Leakages that occurs in the Healthcare Industry?

+The common forms of revenue leakage in the healthcare industry are the uncollected revenue due to missing or incorrect data resulting in underbilling, charges that were never captured or coded, claims submitted with preventable errors and services that are not reimbursed due to documentation gaps. Unlike claim denials these operational inefficiencies or process failures often goes undetected and cannot be corrected later causing revenue leakage.

Q2. In what scenarios does front-desk staff select the wrong insurance payer or plan?

+Selecting the wrong payer/plan may happen when the patient has multiple active plans, but primary vs. secondary is not verified, employer or plan changes is not updated in real time, when there are similar payer names or plan IDs that causes confusion during the selection, when the front desk relies on the patient-reported insurance without validation or the legacy plans remaining active in the practice management system.

Q3. Why are the front-end errors dangerous than the billing/coding mistakes?

+Front-desk errors are dangerous because they are invisible on the denial dashboards and are not reported in the payer feedback, they silently accumulate across departments creating irrecoverable revenue with claims being under coded or never billed at all.

Q4. What are the front-end KPIs that should be tracked by the healthcare organizations?

+The key front-desk metrics that helps to expose the hidden revenue risks are the registration accuracy rate, eligibility verification compliance, wrong-payer capture rate, authorization success rate, and front-end–driven denial trends.

Q5. How does Shoreline Healthcare Technologies help providers to prevent the front-end revenue leakage?

+Shoreline Healthcare Technologies helps healthcare organizations to standardize the front-end workflows; we provide intelligent automation and front-end analytics that helps to eliminate the errors that occurs at the time of appointment scheduling.

Q6. Is ShorelineMB the same as Shoreline Healthcare Technologies?

+Yes, ShorelineMB.com is the official website of Shoreline Healthcare Technologies, a leading provider of medical billing and RCM services.

Contact Shoreline Healthcare Technologies today to optimize your Revenue cycle.